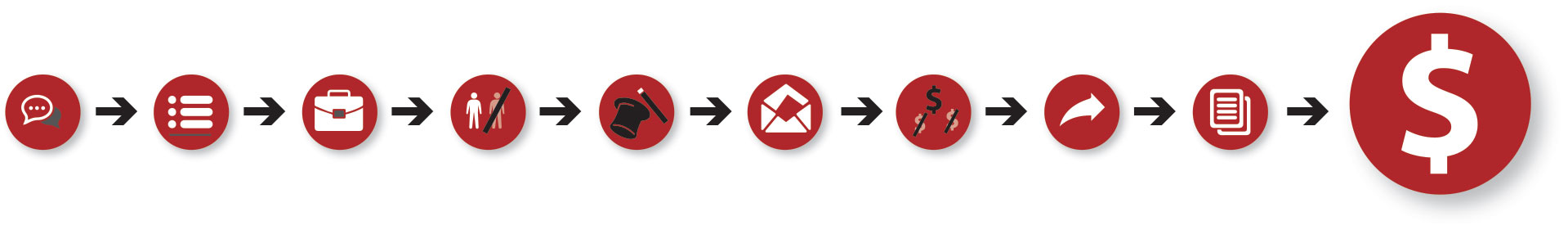

STEP 1: SCHEDULE DISCOVERY MEETING

In the initial discovery meeting, we hear your story and your value proposition. Through a series of questions, we will listen carefully to your individual goals and objectives. We also carefully evaluate whether we can meet those goals and objectives. If we are not 100% confident that we can sell your company for “Maximum Value” we simply will not engage.

STEP 2: EXECUTE LISTING AGREEMENT

A listing agreement or engagement letter is reviewed and signed between you and MDR & Associates, giving us the right to exclusively market your business and represent you for a specified time period and agreed upon price. Once the exclusive listing or engagement letter is signed, we gather an array of data in preparation for building the confidential marketing package and taking the offering to our database of buyers, capital groups and private equity groups.

STEP 3: DESIGN MARKETING PACKAGE & HD VIDEO

With the data provided, we generate a confidential marketing package that includes a detailed business profile and financial picture for prospective buyers. Once the marketing package is completed, we bring your business first to our extensive buyer database of buyers, capital groups and private equity groups. If our stable of buyers does not produce an acceptable offer, we then place a general blind advertisement for your business on all the top “business for sale” sites. Our underlying goal is to achieve maximum exposure in the shortest period of time creating a real sense of urgency for qualified buyers and buyer groups.

STEP 4: SCREEN PROSPECTIVE BUYERS

Before receiving sensitive information about your business, each buyer will sign a confidentially agreement and buyer profile which will determine if they are qualified financially to purchase your business. We then field buyer questions using the data you provided us during the info gathering period. It is fairly typical that during this time we will gather more detailed information about your customers, your products and your financials.

STEP 5: SCHEDULE BUYER / SELLER MEETINGS

This is where the real magic happens. We confidentially schedule all buyer/seller meetings at your convenience. An appointment for a buyer and seller to meet is usually made when a buyer is considering making letter of intent to purchase the business. The buyer would have already reviewed the business profile and financials and received answers to their questions. This is the chance for the buyer to meet the seller, ask questions and get a feel for what it would be like to walk in the owner’s shoes. However, this meeting is not the time to discuss the price and terms of the sale.

STEP 6: RECEIVE MULTIPLE LOI’S (LETTERS OF INTENT)

It is at this time one of our principals clearly communicates the expected price, structure, and transition period expectations. Here we are communicating and negotiating with multiple buyers and buyer groups on behalf of our client. It is extremely important for us to assist all prospective buyers in gaining a real understanding of our client’s personal goals and objectives while minimizing the ping pong that generally kills deals before they ever have time to gain any real momentum.

STEP 7: REVIEW ALL OFFERS WITH OUR CLIENT

We have a fiduciary responsibility to present all offers in person and we are proactive in negotiating every aspect of the buyer’s offer. Proactive negotiation is crucial to achieving a successful sale. We are not only after the right price but also the right structure and the right buyer that will carry on the legacy of the business. We have the expertise required to achieve any and all of our seller’s personal goals and objectives.

STEP 8: BEGIN DUE DILIGENCE PROCESS

Once the best offer has been determined and the LOI has been signed, the due diligence period begins. This is the time when the buyer requests additional documents and materials needed to verify that all representations made by the seller are accurate. Depending on the size of the business, a buyer will typically have about 30-90 days to complete this inspection process.

STEP 9: CREATE ALL LEGAL DOCUMENTS

One key to successful transactions in our business is choosing the right attorney to create the legal documents necessary to close the transaction. We have interviewed hundreds of law firms to find the best and brightest M & A attorneys available in the marketplace. Selecting the right attorney is critical to the success of any deal. Our deal team has worked with the same world-class law firms for years, and they have a proven track record of success.

STEP 10: CLOSE TRANSACTION & WIRE SELLER PROCEEDS

This is what we have all been pushing towards for months. All documents are then finalized by the legal team and approved by both the buyer and his/her advisors and the seller and his/her advisors and a closing date and location is formally scheduled. Typically, the closing takes place in our office where both legal teams are present, all appropriate legal documents are signed, and ownership is transferred. It is then our pleasure to either wire or hand deliver the funds to our client.